According to a study by Max Life, 90% of urban Indians above the age of 50 regret that they did not start their retirement planning early like pension schemes or any other schemes. But if we have to do retirement planning, then National Pension Scheme, which is now National Pension System (NPS) is a very popular retirement scheme which is available for us in the market.

Most people invest in NPS solely for its tax benefits without fully knowing the scheme. But this scheme has some advantages as well as some disadvantages. That is why today we will discuss the NPS scheme in a very easy way for your information on our EPFO Services blog, so that a common man who does not have much knowledge about investment can also know this scheme well and take advantage of it.

What is the National Pension System (NPS)?

NPS is a National Pension Scheme which is now known as National Pension System is a pension scheme, which was launched by our Government of India in 2004 by UPA government and it is regulated by the Pension Fund Regulatory and Development Authority (PFRDA). It was first launched for government employees except Indian Armed Forces,But later in 2009 it was made available to every citizen of India.

Key Benefits of the NPS Scheme

- Tax Benefits: Claim deductions of up to ₹2,00,000 under Section 80CCD.

- Retirement Planning: Build a secure financial future with consistent savings.

- Market-Linked Returns: Investments are diversified across equities, corporate bonds, and government securities for potential growth.

How NPS Works: Where Your Money is Invested

NPS money is invested in the same way as it is invested in mutual funds, in the stock market and in debt, similarly here also some investments are made in the stock market, some in government and some in corporate bonds. Each subscriber of NPS is assigned a 12 digit PRAN number which we know as Permanent Retirement Account Number.

Curious about how the NPS Vatsalya Scheme can secure a brighter future for your child? Read our in-depth guide to understand its benefits, tax savings, and investment potential.

NPS Account Types: Tier I vs. Tier II

NPS offers us two types of accounts:

Tier l

Tier II

| NPS Types | Tier I | Tier II |

|---|---|---|

| Purpose | Retirement Planning | Investment Planning |

| Eligibility | Indian citizens (18-70) | Must hold a Tier I account |

| Lock in | Partial withdrawal after 3 years, full withdrawal at 60 | No lock-in period |

| Minimum Contribution | ₹500 (one-time) | Contribution is not ₹250 (optional) |

| Contribution while opening | ₹500 | ₹1000 |

| Maximum Limit | NA | NA |

| Tax Benefits | upto ₹2,00,000 deductions | None |

Note: Tier I offers the primary tax benefits, making it the more popular account.

Maximizing Your NPS Contributions

This tax benefit is the biggest reason why most people want to invest in NPS.

- Claim up to ₹1,50,000 under Section 80C and an additional ₹50,000 under Section 80CCD(1B).

- Employer contributions to NPS are tax-exempt under Section 80CCD(2).

We do not get any kind of tax deduction facility in Tier-ll account. That is why Tier 1 account is more popular because it offers many tax benefits.

Eligibility: Who Can Join the NPS?

Anyone between the ages of 18 and 70 can open an NPS account, including:

- corporate employees

- government employees

- self-employed

- businessmen

- Non Resident Indians (NRIs)

Getting Started with NPS: A Step-by-Step Guide

Now the question must be coming to your mind that what are the investment options in NPS.

Step 1: Select a Pension Fund Manager (PFM)

The first thing you have to choose Pension Fund Manager (PFMs). There are total of 10 listed PFMs (it could be increse or decrese) within NPS from which we will have to choose one. You can check the List.

| Pension Fund Manager | Main Website | Established | Parent Company |

|---|---|---|---|

| Aditya Birla Sun Life Pension Management Limited | Official Website | 2017 | Aditya Birla Sun Life Insurance Company Limited |

| Kotak Mahindra Pension Fund Limited | Official website | 2009 | Kotak Mahindra Bank |

| LIC Pension Fund Limited | Official website | 2009 | Life Insurance Corporation of India |

| Max Life Pension Fund Management Limited | Official website | 2006 | Max Life Insurance Company Limited |

| SBI Pension Funds Private Limited | Official website | 2004 | State Bank of India |

| HDFC Pension Management Company Limited | Official website | 2009 | HDFC Bank |

| ICICI Prudential Pension Funds Management Company Limited | Official website | 2004 | ICICI Bank & Prudential plc |

| Axis Pension Fund Management Limited | Official website | 2007 | Axis Bank |

| TATA Pension Management Limited | Official website | 2007 | Tata Sons |

| UTI Retirement Solutions Limited | Official Website | 2007 | Unit Trust of India (UTI) |

Step 2: Choose Your Investment Option: Active or Auto Choice

Two different scheme preferences are available for selection in NPS.

Active Choice

Auto Choice

- If we select Active Choice, then we can change something in it every year. Like in which scheme or where the money should be invested.

- Under Auto Choice, our money gets invested automatically.

Understanding NPS Investment Categories

Investment is made under four categories in both the categories i.e. Active Choice and Auto Choice.

- Asset Class A

- Asset class C

- Asset class E

- Asset class G

• Risk Factor – Very High Risk

• Risk Factor – High Risk

• Risk Status – Moderate Risk

• Risk Status – Low Risk

Active Choice vs. Auto Choice: What You Need to Know

1. Active Choice

If any subscriber selects Active Choice, then he gets the freedom to invest his money in any asset class. We have already discussed in which allocations they can invest. The Subscribers have to select PFM and percentage allocation for each asset class as per their Interest.

- Up to 50 years age, we can invest up to 75% of our investment in equity.

- Thereafter it keeps on decreasing by 2.5% every year.

- This means that by the time we reach the age of 60, only 50% of our money can be invested in equity.

- In Active Choice, we can change such allotments, twice a year, this facility is given to us by NPS.

- Also we can’t allocate more than 5% in AIFs Funds.

For your convenience, we have also prepared two charts so that you can understand the maximum allocation you can make for both Tier 1 and Tier 2.

Tier I

Maximum Tier I Asset Allocations

| Asset Class for Investment | Cap |

|---|---|

| Alternate Investment Fund (A) | 5% |

| Corporate Bonds (C) | 100% |

| Equity (E) | 75% |

| Government Securities (G) | 100% |

Tier ll

Maximum Tier Il Asset Allocations

| Asset Class for Investment | Cap |

|---|---|

| Equity (E) | 100% |

| Corporate Bonds (C) | 100% |

| Government Securities (G) | 100% |

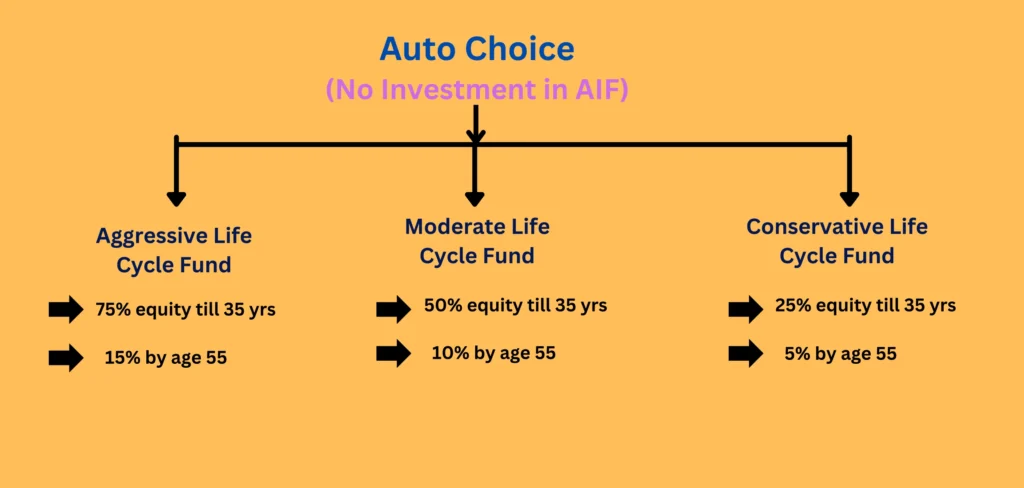

2. Auto Choice

In Auto Choice, the investment allocation is decided by the pension fund manager, it completely depends on the age of the subscriber. Once you select Auto Choice, the pension fund manager will automatically invest accordingly in the future.

There are 3 types of options available in Auto Choice:

- LC75 – Aggressive Life Cycle Fund

- High risk, high return potential fund.

- Suitable for young investors with a long-term investment horizon.

- Invests primarily in equities (up to 75% of the portfolio).

- Gradually reduces equity exposure over time to mitigate risk as the investor ages.

| Age | Asset Class E | Asset Class C | Asset Class G |

|---|---|---|---|

| Up to 35 years | 75 | 10 | 15 |

| 36 years | 71 | 11 | 18 |

| 37 years | 67 | 12 | 21 |

| 38 years | 63 | 13 | 24 |

| 39 years | 59 | 14 | 27 |

| 40 years | 55 | 15 | 30 |

| 41 years | 51 | 16 | 33 |

| 42 years | 47 | 17 | 36 |

| 43 years | 43 | 18 | 39 |

| 44 years | 39 | 19 | 42 |

| 45 years | 35 | 20 | 45 |

| 46 years | 32 | 20 | 48 |

| 47 years | 29 | 20 | 51 |

| 48 years | 26 | 20 | 54 |

| 49 years | 23 | 20 | 57 |

| 50 years | 20 | 20 | 60 |

| 51 years | 19 | 18 | 63 |

| 52 years | 18 | 16 | 66 |

| 53 years | 17 | 14 | 69 |

| 54 years | 16 | 12 | 72 |

| 55 years & above | 15 | 10 | 75 |

- LC50 – Moderate Life Cycle Fund

- Balanced approach to risk and return.

- Suitable for investors seeking a mix of growth and stability.

- Invests up to 50% of the portfolio in equities.

- Gradually reduces equity exposure over time to manage risk as the investor ages.

| Age | Asset Class E | Asset Class E | Asset Class G |

|---|---|---|---|

| Up to 35 years | 50 | 30 | 20 |

| 36 years | 48 | 29 | 23 |

| 37 years | 46 | 28 | 26 |

| 38 years | 44 | 27 | 29 |

| 39 years | 42 | 26 | 32 |

| 40 years | 40 | 25 | 35 |

| 41 years | 38 | 24 | 38 |

| 42 years | 36 | 23 | 41 |

| 43 years | 34 | 22 | 44 |

| 44 years | 32 | 21 | 47 |

| 45 years | 30 | 20 | 50 |

| 46 years | 28 | 19 | 53 |

| 47 years | 26 | 18 | 56 |

| 48 years | 24 | 17 | 59 |

| 49 years | 22 | 16 | 62 |

| 50 years | 20 | 15 | 65 |

| 51 years | 18 | 14 | 68 |

| 52 years | 16 | 13 | 71 |

| 53 years | 14 | 12 | 74 |

| 54 years | 12 | 11 | 77 |

| Asset Class G | 10 | 10 | 80 |

- LC25 – Conservative Life Cycle Fund

- Low risk, low return fund.

- Suitable for risk-averse investors seeking capital preservation.

- Invests up to 25% of the portfolio in equities.

- Gradually reduces equity exposure over time to prioritize stability.

| Age | Asset Class E | Asset Class C | Asset Class G |

|---|---|---|---|

| Up to 35 years | 25 | 45 | 30 |

| 36 years | 24 | 43 | 33 |

| 37 years | 23 | 41 | 36 |

| 38 years | 22 | 39 | 39 |

| 39 years | 21 | 37 | 42 |

| 40 years | 20 | 35 | 45 |

| 41 years | 19 | 33 | 48 |

| 42 years | 18 | 31 | 51 |

| 43 years | 17 | 29 | 54 |

| 44 years | 16 | 27 | 57 |

| 45 years | 15 | 25 | 60 |

| 46 years | 14 | 23 | 63 |

| 47 years | 13 | 21 | 66 |

| 48 years | 12 | 19 | 69 |

| 49 years | 11 | 17 | 72 |

| 50 years | 10 | 15 | 75 |

| 51 years | 9 | 13 | 78 |

| 52 years | 8 | 11 | 81 |

| 53 years | 7 | 9 | 84 |

| 54 years | 6 | 7 | 87 |

| 55 years & above | 5 | 5 | 90 |

Use the NPS Calculator to Plan Your Retirement

Use the NPS Calculator to estimate your retirement corpus and monthly pension. Adjust your contributions and investment choices to see how your funds grow over time.

NPS Withdrawal Rules and Tax Implications

As you know this is a retirement plan so you will get maximum money only after retirement, But after 3 years of your contribution you can withdraw up to 25% of your total contribution.

Let’s see with an example:

Your Total Contributions or Initial investment made by you: ₹1,00,000

- Investment Growth: suppose your amount after growth is around ₹1,25,000 to ₹3,00,000

- Time Period: 3 years

- Calculation:

- Maximum Withdrawal Amount: 25% of Total Contributions (Paid by you only)

- Maximum Withdrawal Amount: 25% * ₹1,00,000 = ₹25,000

So, in this scenario, you can withdraw a maximum of ₹25,000 after 3 years, provided you meet the eligibility criteria and the withdrawal is for a specified reason.

Conditions for Partial Withdrawals from NPS

- Minimum 3-year Tenure: You must have been an NPS subscriber for at least 3 years.

- Limited Withdrawals: You can make a maximum of 3 partial withdrawals during the entire tenure of your subscription

- Maximum Withdrawal Limit: You can withdraw a maximum of 25% of the total contributions made by you.

- Specific Reasons: The withdrawal must be for specific reasons, such as:

- Marriage of children.

- Purchase or construction of a residential house (under certain conditions).

- Treatment of critical illnesses.

Official Sources for NPS Information:

Additional Frequently Asked Questions About NPS

Can I change my Pension Fund Manager (PFM) after selecting one?

Yes, NPS allows you to change your Pension Fund Manager once per financial year. This flexibility enables you to adjust your investment strategy based on performance and personal goals.

What happens to my NPS account if I change jobs or relocate to another city?

Your NPS account remains active and portable throughout India, irrespective of changes in your employment or location. You can continue contributing from any location or job without needing to open a new account.

How is my NPS pension taxed upon withdrawal?

NPS withdrawals have specific tax treatments. At retirement, up to 60% of the corpus can be withdrawn as a lump sum, which is tax-free, while the remaining 40% must be used to purchase an annuity, which will be taxed as per your income slab at the time.

Is there an option to pause NPS contributions temporarily?

Yes, you can temporarily stop contributing to NPS if needed. However, the account may become dormant, and a penalty may apply. To reactivate it, you would need to pay the minimum contributions along with any penalties.

What if I need to access my NPS savings early? Are there exceptions for emergencies?

NPS allows partial withdrawals after three years for specific reasons, such as higher education, marriage of children, purchase of a house, or critical illness treatment for self or family members.

Can I nominate someone to receive my NPS corpus in case of my death?

Yes, NPS subscribers can nominate individuals who would receive the accumulated funds in the event of the subscriber’s death. Nomination details can be updated or changed at any time through the NPS account portal or Point of Presence (POP).