Many farmers in rural areas have always faced the risk of losing their crops due to unpredictable weather or pests. But with the introduction of Pradhan Mantri Fasal Bima Yojana (PMFBY), they now have a way to protect their crops with affordable crop insurance. Farmers, whether using their mobile phones or visiting a local cybercafe, can now easily apply for this government scheme online. If you’re wondering how to apply for PMFBY online.

This article will guide you through the process, step-by-step, so you too can secure your crops and livelihood with the PMFBY scheme.

Benefits of Applying for PMFBY Online

Applying for Pradhan Mantri Fasal Bima Yojana (PMFBY) online is easier than ever. Here’s why you should consider online process instead offline:

- Convenience: Apply from the comfort of your home, cyber cafe, or from your mobile at any time.

- Speed: Faster application process compared to offline methods.

- Transparency: Easily track your application status online.

- Reduced Paperwork: Upload documents directly on the portal.

What Documents Are Required for PMFBY Online Application?

Before You start your application process, arrange all the necessary documents. This will save yout time and prevent errors. Here’s what you need:

- Aadhaar Card for identity verification.

- Bank Account Details to receive any claims directly.

- Land Ownership Records.

- Crop-Sowing Details to specify the crops you want to insure.

- Past Insurance Records (if applicable).

Step-by-Step Guide to PMFBY Online Application

Here’s a clear, easy-to-follow guide to applying for PMFBY online:

Note:- Direct online enrollment of farmers is not available on NCIP for Karnataka and Gujarat as these State enroll the farmers through their own portal.

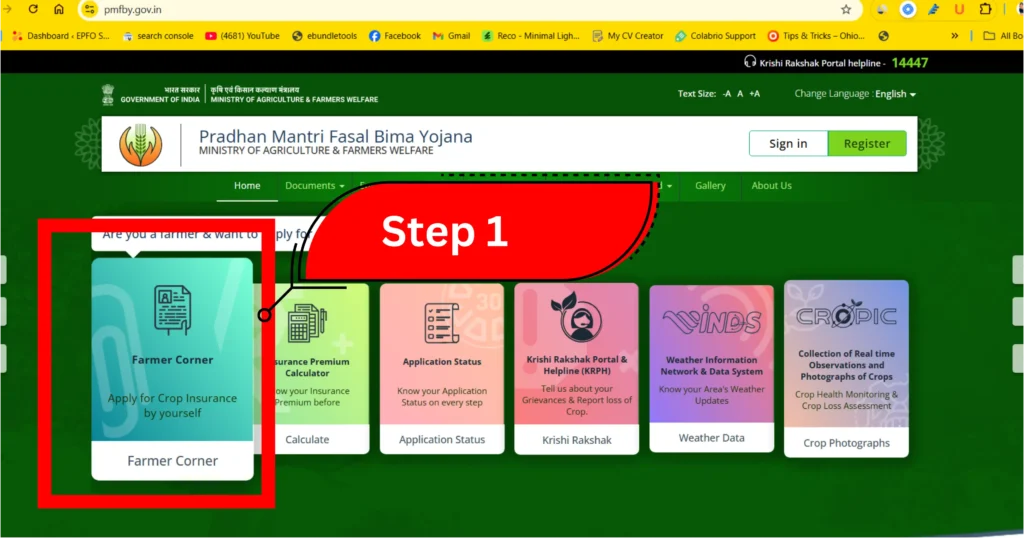

Step 1: Visit the Official PMFBY Portal

Go to the official website → pmfby.gov.in.

Step 2: Register or Log In

1. Choose Farmer Option

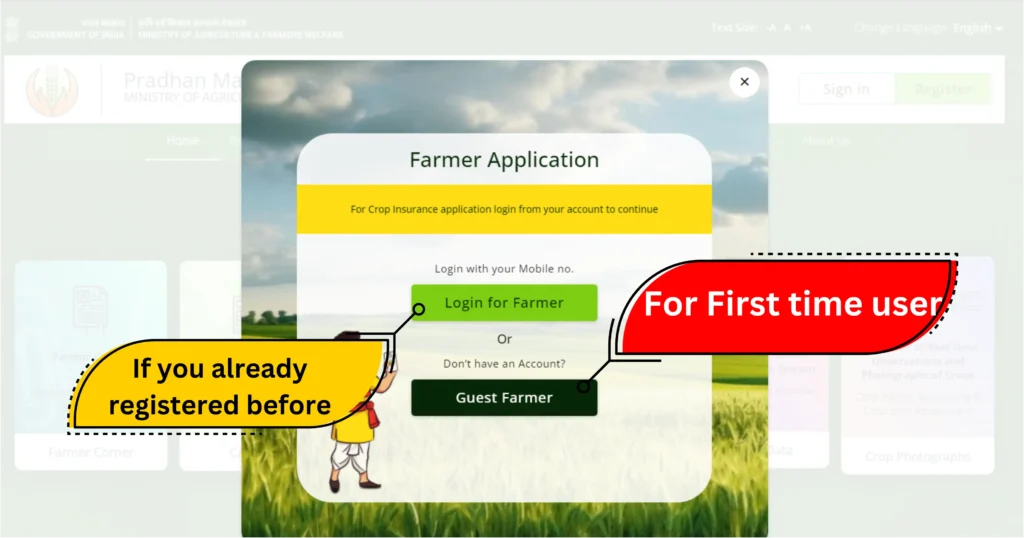

After selecting on the “Farmer” option, two choices will appear on the screen:

- Login for Farmer: If you are already registered, select this option to log in.

- Guest Farmer: If you are a first-time user, Then click this → “Guest Farmer” option.

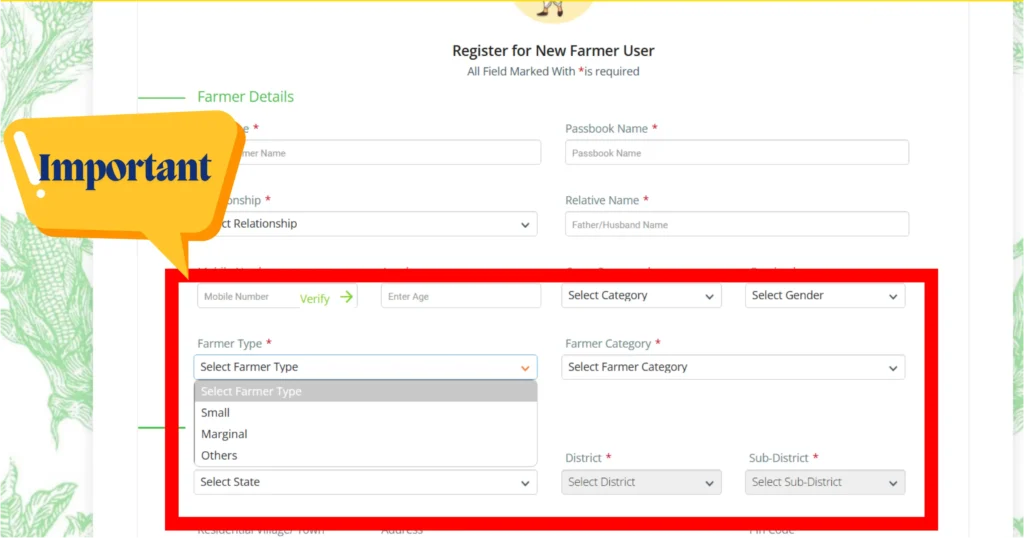

2. New Farmer Registration

A registration page will open. Fill in the following details very carefully, like Farmer Details, Residential Details, Farmer ID, Account Details, Captcha and submit.

Fill Farmer Details:

- Full Name

- Enter your full name as per your official documents (e.g., Aadhaar Card, PAN Card) to avoid discrepancies.

- Passbook Name

- Ensure you write the name exactly as it appears in your bank passbook. This helps in seamless verification for payments.

- Relationship & Relative Name

- Select your relationship from the options (e.g., Son, Daughter, Wife).

- Mention the name of your relative (e.g., Father, Husband) accurately.

- Mobile Number

- Provide your active mobile number.

- Verify it by entering the OTP (One-Time Password) sent to your phone.

- Age, Caste Category, Gender

- Age: Ensure it’s correct to match your eligibility criteria.

- Caste Category: Select your category (e.g., General, SC, ST, OBC).

- Gender: Choose from Male, Female, or Others.

↓

Select Farmer Type: Choose your category:

Small Farmer

Marginal Farmer

Others

Farmer Category: Select the proper option:

- Owner

If you own the farmland, select this option. This is typically for individuals who have legal ownership or hold the land title. - Tenant

Choose this if you rent the farmland from another owner to cultivate crops. - Share Cropper

If you work on another person’s land and share the produce or profits as per an agreement, select this category.

Farmer ID:

- Select the type of ID (e.g., Aadhaar) and enter the ID number.

- Enter the ID number. Click “Verify” to validate it.

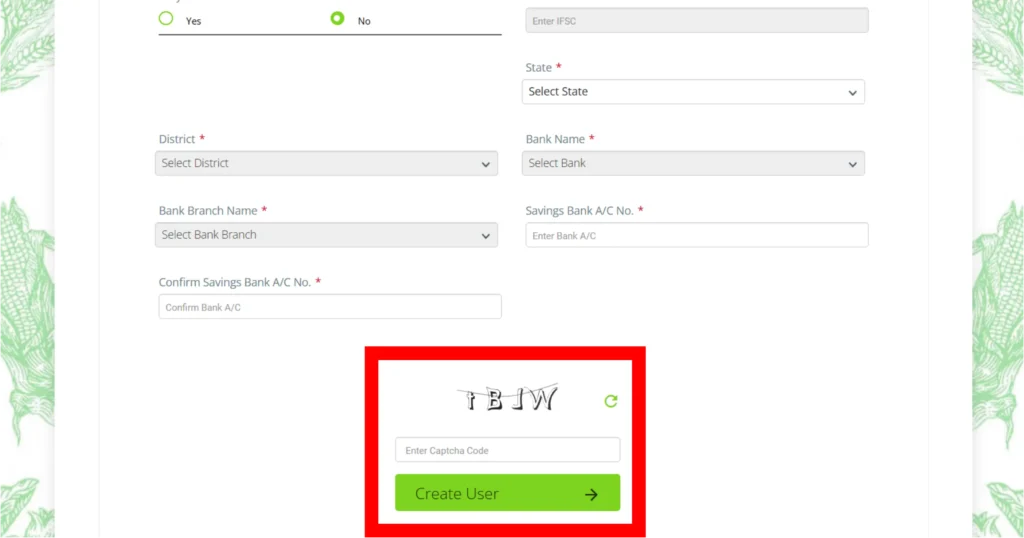

Account Details:

- Refer to your bank passbook and carefully enter all the account details, such as Account Number and IFSC code.

- Enter the captcha code shown on the screen.

- Click “Create User” to complete the registration process.

Once registered, you will receive an SMS confirmation with your login details. These details will also be displayed on the screen. It’s a good idea to note them down on paper for future reference to avoid any inconvenience.

Step-by-Step Process After Creating a User ID

- Log In:

- Go to the “Farmer for Login” option.

- Enter the registered phone number (the one you used to create your ID) and log in.

- Access Insurance Application:

- A new page will open.

- At the top of the page, click on “Apply for Insurance”.

- Review and Update Details:

- Prefilled details will appear.

- If there are mistakes or blank fields, you can edit or fill them in again.

- Ensure all details are accurate before proceeding.

- Fill in Necessary Details:

- Personal Details: Check and complete your personal information.

- Bank Details: Verify and fill in your account details carefully.

- Crop Details:

- Select State, Scheme, Season (e.g., Kharif or Rabi), and Year.

- Choose whether it’s a Mixed Crop (Yes/No).

- Select your specific crop.

- Enter the Sowing Date (the date you planted the crop).

- Provide the Survey Number of your land, the Plot Number, and the Area in hectares.

- Use our Decimal to Hectare Calculator to make this easier. (Click here to calculate).

- Press Add to save your details.

- Upload Required Documents:

- Upload scanned copies of the following:

- Bank Passbook

- Land Details

- Sowing Certificate (Download the form from the official website, print it, fill it out, and upload).

- Tenant Certificate (if applicable).

- Upload scanned copies of the following:

- Preview and Submit:

- A preview of all your details will appear on the screen.

- Double-check everything.

- If all the details are correct, press Submit.

- Make Payment:

- A payment page will open.

- Deduct ₹1 from your account using any of these methods:

- ATM Card

- Online Banking

- UPI (the easiest option).

- Receive Receipt:

- After the payment is successful, you will receive a receipt.

- Download or print it for your records.

And that’s it! You’ve successfully applied for PMFBY insurance online in the easiest way possible!

Common Mistakes to Avoid in PMFBY Online Application

To ensure your application is processed smoothly, avoid these mistakes while applying:

- Missing Deadlines: Apply early to ensure coverage. Applications are only accepted during specific windows.

- Incorrect Details: Verify land and bank details carefully to avoid mismatches.

- Incomplete Documents: Upload clear and complete documents to prevent rejection.

How to Check PMFBY Application Status?

Tracking your PMFBY application status is easy:

- Visit the PMFBY portal.

- Click on the “Application Status” option.

- Enter your “Reciept Number” and solve the captcha.

- View the current status and take action if required.

Troubleshooting Common PMFBY Online Application Errors

Are you facing any error? Here’s how to resolve common errors:

- Website Not Loading: Try accessing the website during non-peak hours or use a different browser or you can use few hours later.

- Payment Failure: Always double-check your bank account balance and confirm your internet connection is stable or not. Retry or contact your bank if the issue persists. Otherwise payement automatically will be credited in your bank.

- Login Problems: Reset your password using the “Forgot Password” option. Ensure your mobile number is active for OTP verification. Also you can clear your browser cookies and caches.

Alternative Ways to Apply for PMFBY

If the online process doesn’t work for you, you can try other alternatives like:

- Offline at Local Centers: You can visit the nearest agriculture department or bank. Their staff will assist you in filling out the application form.

- Common Service Centers (CSCs): Operators at CSCs can help farmers complete the process for a nominal fee. You can also call:

- Krishi Rakshak Portal helpline –14447.

- Mobile Applications: Use government-approved apps like Kisan Suvidha to apply on your smartphone.

PMFBY Online Application FAQs

Can tenant farmers apply for PMFBY online?

Yes, tenant farmers can apply by providing valid land agreements and crop-sowing details.

What should I do if my application is rejected?

Contact the PMFBY helpline for clarification and resubmit with correct details.

Is there a fee for online applications?

The premium amount varies depending on the crop and coverage selected. No additional fees are charged for applying online.

Conclusion

After understanding our article regarding how to apply for PMFBY online, many farmers have found it simple to secure insurance for their crops. Whether using their smartphones or visiting a cybercafe, they can now protect their crops from unexpected losses.

Pradhan Mantri Fasal Bima Yojana has made it easier for farmers across the country to access crop insurance, and the online application process ensures that no one is left behind. If these farmers can do it, so can you—take action today and safeguard your crops under the PMFBY scheme.

Start your application today and take a step toward a safer and more secure farming future. Visit official website for pmfby.gov.in to begin.