Simple Mortgage Calculator with Part-Payment Feature – Plan Your Loan Easily

Home Loan Calculator

Monthly EMI

₹0

Total Interest

₹0

Total Payment

₹0

Planning your mortgage or home loan repayments? Our Simple Mortgage Calculator is your one-stop solution. Whether you’re a first-time buyer or refinancing, this tool helps you estimate EMIs, total interest, and the savings from part-payments — all in real time.

Key Features of the Simple Mortgage Calculator

- User-Friendly: No technical knowledge required. Just input your loan details and see results instantly.

- Quick EMI Calculation: Enter the mortgage amount, interest rate, and tenure to calculate monthly or yearly EMIs.

- Total Repayment View: Displays total interest payable and the full cost of your loan.

- Flexible EMI Frequency: Choose between monthly or yearly EMI as per your financial plan.

- Amortization Schedule: Get a clear breakdown of principal and interest for each payment cycle.

Exclusive Part-Payment Option

- Multiple Part-Payments: Add extra payments at different stages of your loan term.

- Choose Your Strategy: Reduce EMI while keeping the tenure same or reduce the tenure while keeping EMI same.

- Real-Time Impact: See updated loan tenure, EMIs, and interest savings instantly.

- Dynamic Amortization Schedule: Visual breakdown of how each part-payment impacts your mortgage over time.

- Amount in Words: Converts large numbers (like lakhs/crores) to words for easier understanding.

- One-Click Reset: Clear the calculator quickly to try new inputs.

How to Use the Mortgage Calculator

- Enter your mortgage amount, interest rate, and tenure.

- Add any part-payments you plan to make.

- Choose whether you want to reduce EMI or reduce tenure.

- Instantly view:

- Adjusted EMIs or loan duration

- Total interest saved

- Month-wise repayment schedule

How EMI and Part-Payments Work

1. EMI Calculation

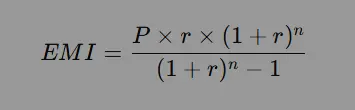

EMI (Equated Monthly Installment) is the amount you pay every month to repay your loan. The EMI is calculated using this simple formula:

Where:

- P is the loan amount.

- r is the monthly interest rate (annual rate divided by 12).

- n is the number of months in the loan term.

The EMI stays the same every month, but part of it goes toward paying off the loan amount, and part covers the interest. The calculation makes sure your loan is repaid in equal monthly installments.

2. How Multiple Part-Payments Work in the Amortization Schedule

When you make part-payments:

- Principal Reduces: The outstanding loan amount decreases immediately.

- Dynamic Adjustment: The schedule recalculates based on user preference:

- Reduce Loan Tenure: Same EMI, shorter duration.

- Reduce EMI: Lower EMI, same duration.

With multiple part-payments at different times, the calculator updates the schedule to show:

- Adjusted EMIs or tenure.

- Total interest saved.

- Month-by-month breakdown reflecting each part-payment’s impact.

Why Part-Payments Matter

Part-payments are extra payments you make to reduce your loan amount. By paying more than your regular EMI, you can lower the total interest you owe and finish your loan sooner.

Benefits of This Home Loan Calculator

- Simple and Easy to Use: No complicated steps or financial knowledge needed.

- Clear Savings: Know exactly how much you’ll save with part-payments.

- Real-Time Updates: Make changes and see results instantly.

If you’re planning to buy a home under the Pradhan Mantri Awas Yojana (PMAY), this calculator is a great way to plan your loan and maximize your savings. Learn more about PMAY.

Offer on Mortgage Calculator Tools

Get full access to our mortgage calculator with all advanced features, part-payments, real-time EMI updates, interest savings, and more — absolutely free. No sign-up. No ads.

Related Tools and Guides

- 👉 9 Effective Ways to Save Interest on Home Loans

- 👉 Apply for PMAY Online

- 👉 PMAY 2.0: Reducing Corruption in Housing

🏡 Buying a House under PMAY?

If you’re applying for a loan under Pradhan Mantri Awas Yojana (PMAY), this tool helps you plan EMIs smartly while exploring your eligibility and subsidy options.

🔗 Learn more here: PMAY Central and State Housing Schemes

Frequently Asked Questions (FAQs)

Q1. Can I use this calculator for any home loan or mortgage?

Yes, this works for all home and mortgage loans — fixed, floating, and even refinance.

Q2. What is a part-payment in mortgage?

A part-payment is an extra amount you pay toward your loan principal apart from the regular EMI. It helps reduce your interest or loan term.

Q3. Should I reduce EMI or loan tenure with part-payments?

Reducing loan tenure is usually more beneficial in terms of total interest saved, but reducing EMI can improve monthly cash flow.

Q4. Does the calculator support government subsidies like PMAY?

The calculator estimates your repayments, but PMAY subsidies are calculated separately. Refer to official portals for exact eligibility.

Q5. Can this tool show amortization changes after each part-payment?

Yes. The amortization schedule updates dynamically with every extra payment entered.

Explore our full range of calculators to simplify your tasks. 👉 Discover More Calculators