Many people struggle with the high cost of home loan interest, which can feel overwhelming. With my experience working at SBI Securities and assisting customers with SBI Home Loans, I’ve learned practical ways to help borrowers save money. This guide provides simple, effective strategies and insights into recent RBI regulations to help you reduce the financial strain and Save Interest on Home Loans.

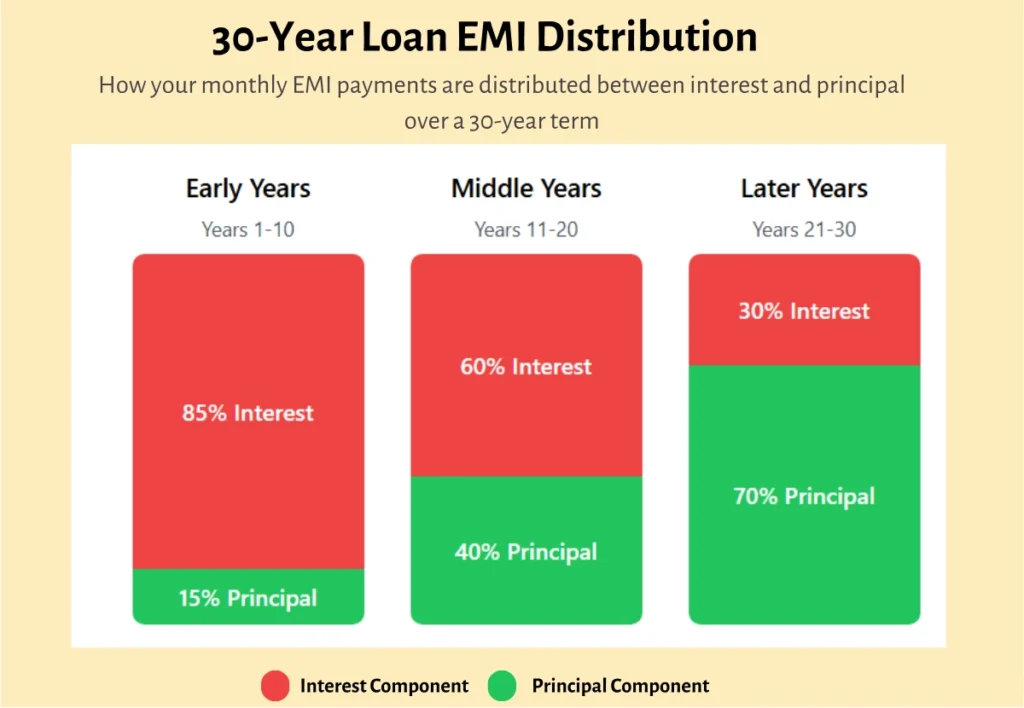

Understanding EMI Breakdown

Initial Phase: In the early years of a loan, most of your EMI goes toward interest, with only a small portion reducing the principal.

Later Years: Over time, this ratio shifts, with more of the EMI going toward the principal and less toward interest. Understanding this helps you see the impact of prepayments and tenure adjustments.

- First decade (Years 1-10): Most of your EMI goes to interest payments due to the large outstanding principal

- Middle decade (Years 11-20): You start paying more towards principal as the outstanding loan amount decreases

- Final decade (Years 21-30): Majority of your EMI goes towards principal reduction

- This pattern occurs because interest is calculated on the remaining principal, which gradually decreases over time

1. Choose a Loan with the Lowest Interest Rate

- Compare Offers: Always check and compare interest rates offered by different banks and NBFCs (Non-Banking Financial Companies). Public sector banks often provide competitive rates. Online loan comparison tools can simplify this process for you.

- Negotiate: If you have a good credit score (750+), negotiate with your lender for a better rate. Highlight your stable income and repayment history.

- Balance Transfer: Also consider transferring your loan balance to another lender if they offer a good lower interest rate. However, calculate the total savings after accounting for processing fees and other charges to ensure it’s worthwhile.

2. Pick a Shorter Loan Tenure

- Save on Interest: A shorter loan tenure reduces the total interest paid, even though it increases your monthly EMI. For example, a 15 year loan saves more interest than a 20 year loan.

- Use EMI Calculators: Tools like home loan EMI calculators help you understand how tenure impacts your total interest and monthly payments. Ensure the EMI fits within your monthly budget while maximizing savings.

Use our Home Loan Calculator to see how part payments reduce interest and access your amortization schedule.

3. Make Prepayments to Reduce Interest

- Prepayment Benefits: Use bonuses, tax refunds, or savings to make part-payments toward your loan. This directly reduces the principal amount, which lowers the interest payable.

- Pre-paying your home loan as early as possible saves significant interest. For instance, pre-paying ₹1 lakh in the first year could save up to ₹3 lakh in interest, whereas doing the same in the 200th month may only save ₹30,000.

- Even small, regular pre-payments like one extra EMI per year can reduce the loan tenure by years and save lakhs in interest.

- No Penalties on Floating-Rate Loans: As per RBI guidelines, lenders cannot charge penalties for prepaying floating-rate loans, making prepayments a cost-effective way to save.

- Timing Matters: earlier you make prepayments, the more you save on interest. Aim to make lump-sum payments during the initial years of the loan.

4. Gradually Increase Your EMI Amount

- Leverage Income Growth: As your income grows either you are salaried or self-employed, increase your EMI amount. Paying higher EMIs allows you to clear the principal faster, which reduces the overall interest burden.

- Set Milestones: Review your financial situation annually and decide on incremental EMI hikes that align with your increased earnings.

5. Choose Daily Reducing Balance Loans

- Daily Calculations Save Money: Opt for loans where interest is calculated daily on the outstanding principal. This ensures you pay less interest over the loan tenure compared to loans with annual or monthly reducing balances.

- Confirm Terms: Check with your lender about the calculation method to ensure transparency.

Learn about the benefits and eligibility

of Pradhan Mantri Awas Yojana (PMAY) – Urban 2.0

6. Monitor Market Interest Rates

- Track Repo Rate Changes: The RBI’s repo rate impacts loan interest rates. For example, recent repo rate cuts have led to lower home loan rates. Use this information to negotiate better rates or switch lenders.

- Switch When Rates Drop: If your lender doesn’t pass on the benefits of a reduced repo rate, consider switching to a new lender offering lower rates. Monitor economic news and announcements for trends.

7. Maximize Tax Benefits on Home Loans

Home loans come with several tax-saving options:

- Section 80C: Deduction of up to ₹1.5 lakh on principal repayment.

- Section 24(b): Deduction of up to ₹2 lakh on interest paid for self-occupied properties.

- Section 80EEA: Additional deduction of up to ₹1.5 lakh on interest for first-time homebuyers (valid until March 2025).

Note: In a joint loan, both co-applicants can claim tax deductions on principal and interest under Section 80C and Section 24, effectively doubling the tax benefits.

8. Avoid Missing EMIs

- Timely Payments Save Money: Missing EMI payments not only attracts penalties but also increases your overall interest burden. It can also negatively affect your credit score.

- Automation is Key: Set up auto-debit or reminders to ensure timely payments. Keep an eye on your bank account balance to avoid failed transactions.

9. Balance Transfer Loans

- Evaluate Costs and Benefits: If you’re considering refinancing your home loan, ensure the savings from lower interest rates outweigh the refinancing costs, such as processing fees. Use a balance transfer calculator to help with the decision.

- Timing Matters: Balance-transfer is most beneficial in the early stages of your loan when the interest component is higher.

RBI Regulations to Help Borrowers Save on Home Loans

- External Benchmark Linked Rates (EBLR): Since October 2019, banks are required to link home loan rates to external benchmarks like the repo rate. This ensures faster transmission of rate cuts to borrowers.

- No Prepayment Penalties: RBI rules prohibit prepayment penalties on floating-rate loans, encouraging borrowers to save through prepayments.

- Loan Restructuring: Borrowers facing financial hardships (e.g., due to the COVID-19 pandemic) can request loan restructuring, such as extending the tenure or reducing EMIs temporarily.

- Transparent Lending Practices: Lenders must clearly disclose all terms, including interest rates and fees, ensuring borrowers can make informed decisions.

- No negative amortization allowed due to rate increases.

- Quarterly updates on loan details, including outstanding balance and EMI.

- Property Document Rules:

- Banks must return property documents within 30 days of loan repayment.

- Delay beyond 30 days results in a penalty of ₹5,000 per day.

- Standardized processes for heirs to retrieve documents in case of the borrower’s death.

Fixed vs. Floating Interest Rates: Which is Better for You?

- Fixed Rate: The interest remains constant, providing stability but may be slightly higher. It’s ideal for those who prefer predictable payments.

- Floating Rate: Tied to the repo rate, it can offer savings during declining rate periods but increases costs when rates rise. Floating rates are often more cost-effective during periods of decreasing repo rates.

- Consider a Hybrid: Some lenders offer hybrid loans that combine fixed and floating rates. Evaluate this option based on your financial goals.

Avoiding Hidden Tenure Extensions and Extra Interest

When interest rates rise, banks may extend your loan tenure without notice to keep your EMI the same. Proactively ask your bank to maintain the original tenure, even if it means increasing your EMI. This strategy can save you lakhs in interest payments.

Example Scenarios: How Prepayments Can Save You Money

Scenario 1

- Loan Amount: ₹50 lakhs

- Tenure: 20 years

- Interest Rate: 8.5%

- Prepayment: ₹5 lakhs after 5 years.

Savings: By prepaying ₹5 lakhs, you can save approximately ₹12 lakhs in interest and reduce your tenure by 3 years.

Scenario 2

- Loan Amount: ₹50 lakhs

- Tenure: 20 years

- Interest Rate: 8.5%

- Prepayment: ₹2 lakhs every 2 years.

Savings: By making ₹2 lakh prepayments every 2 years, you can save over ₹15 lakhs in interest and reduce your loan tenure by approximately 5 years.

Tools to Help You Save on Your Home Loan

- EMI Calculator: Understand your monthly payments and total interest.

- Balance Transfer Calculator: Check potential savings before transferring your loan.

- Tax Savings Calculator: Maximize deductions under various sections.

- Loan Restructuring Tools: Explore tools offered by banks to evaluate restructuring options during financial difficulties.