If you or your loved one is struggling with a disability, it can be challenging to cover medical care expenses. The Niramaya Health Insurance Scheme provides medical coverage up to ₹1 lakh which includes hospitalization, surgery, therapy and more.

This scheme has been specially designed with the objective of reducing the burden of health care for differently abled people and their families. The scheme ensures that medical treatment is accessible and affordable so that beneficiaries can receive the necessary assistance as soon as possible.

Table of Contents

What is the Niramaya Health Insurance Scheme?

The Niramaya Health Insurance Yojana is a government initiative started by the National Trust, a statutory body under the Ministry of Social Justice and Empowerment, Government of India. This scheme provides health insurance coverage to persons with disabilities (PWD) so that they can avail medical treatment and therapies without any financial constraints. Through this scheme you can also avail out-patient-department (OPD) care, hospitalisation, surgery and many other services. These facilities making it a valuable support system for PWDs in their lives.

Who Can Apply for Niramaya Health Insurance?

The scheme is available for individuals with disabilities in the following categories:

- Autism (A developmental condition that affects communication, behaviour, and social skills)

- Cerebral Palsy (A condition caused by brain damage, leading to difficulties in movement and muscle coordination)

- Mental Retardation (Now referred to as intellectual disability; a condition that affects learning and problem-solving abilities)

- Multiple Disabilities (A combination of two or more disabilities, such as physical and intellectual challenges)

Key Criteria:

- No age restrictions apply.

- Applicants must have a valid disability certificate.

- Both Below Poverty Line (BPL) and Above Poverty Line (APL) families can enroll.

Benefits of Niramaya Health Insurance Scheme

Niramaya Shastra Insurance Scheme provides coverage of various medical treatments for persons with disabilities (PWD), making it a great help for them.

- Medical Treatment: Coverage includes outpatient care, hospitalization, surgery, and therapy services like physiotherapy and speech therapy.

- Financial Relief: This scheme is designed to reduce the financial burden of the beneficiaries by covering medical expenses up to ₹1,00,000.

- Emergency Services: The scheme also covers emergency transportation and other critical medical expenses such as medicines.

Capping/Limit for Funds under Each Category of the Niramaya Scheme:

| Section | Sub-Section | Description | Limit |

|---|---|---|---|

| 1. Hospitalization | Overall Limit of Hospitalization | ₹70,000/- | |

| A. Corrective Surgeries for Existing Disabilities | Surgeries to treat existing disabilities, including those from birth | ₹40,000/- | |

| B. Non-Surgical/Hospitalization Treatment | Non-surgical treatments during hospitalization | ₹15,000/- | |

| C. Surgery to Prevent Further Aggravation of Disability | Surgery to prevent worsening of disability | ₹15,000/- | |

| 2. OPD (Outpatient) | Overall Limit for OPD | ₹14,500/- | |

| A. OPD Treatment | Including medicines, pathology, diagnostic tests, etc. | ₹8,000/- | |

| B. Regular Medical Check-up | For non-ailing disabled individuals | ₹4,000/- | |

| C. Dental Preventive Dentistry | Routine dental care and preventive treatments | ₹2,500/- | |

| 3. | Ongoing Therapies to Reduce Impact of Disability | ₹10,000/- | |

| 4. | Alternative Medicine | ₹4,500/- | |

| 5. | Transportation Costs | ₹1,000/- | |

| Overall Limit for a Person | ₹1,00,000/- | ||

What Makes Niramaya Health Insurance Unique?

- No Medical Screening Required: Applicants can enrol without any pre-medical tests.

- Covers All Disabilities: Inclusive of all persons with disabilities (PWD) under the National Trust Act, 1999.

- Pre-Existing Conditions Included: Ensures comprehensive coverage from the first day of enrollment.

- Affordable Premiums: Designed to be accessible for low-income families.

how to apply for Niramaya Health Insurance

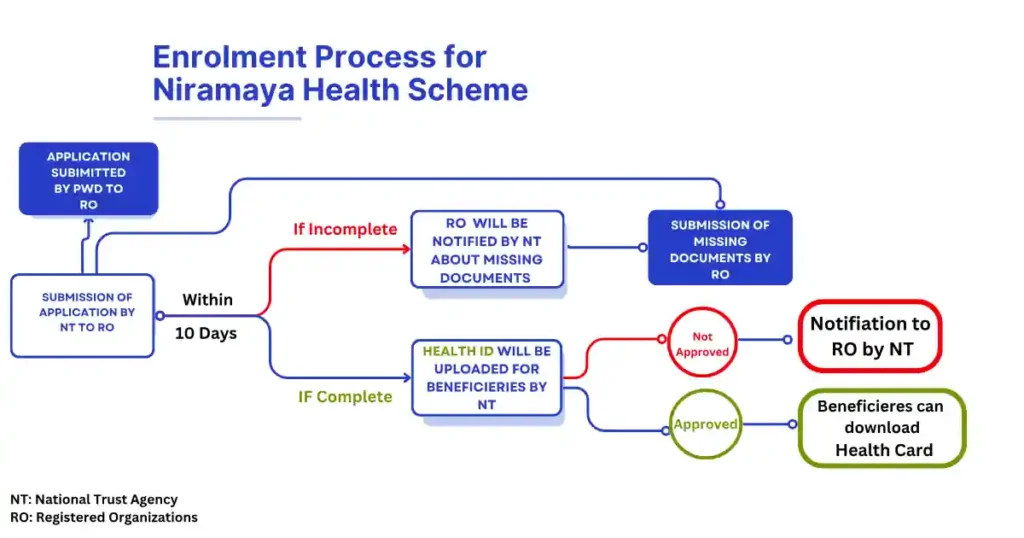

Before starting the application process for the Niramaya Health Insurance Scheme, you need to get initial approval through Registered Organizations (ROs). Below is a simple breakdown of the Enrolment Fee and the Required Documents for both BPL and APL categories.

Here’s the simplified step-by-step process for enrolling in the Niramaya Health Insurance Scheme:

1. Visit the Nearest Registered Organization (RO): First find the nearest Registered Organization (RO) by visiting the official National Trust website. The parent or guardian of the person with a disability should contact the RO for assistance in the application process. Ensure you bring along important documents like a disability certificate and identity proof (Check 5th step for document and fees).

2. Meet the RO Staff: Once you reach there, you will be guided by the staff there who will help you in the application process and will also explain you the steps and documents required. You may have to pay ₹40 per form for processing, so please keep an extra money along with the application fee.

3. Fill the Application Form: RO staff will help you to fill up the Health Insurance Application Form online. Make sure that the name of the disabled person, category of disability and his/her personal details are entered correctly.

4. Verify Your Documents: RO will check the original documents carried by you like Disability Certificate, Address Proof and Identity Proof to ensure their validity and approve your application as soon as possible.

5. Application Fee and Documents Checklist: Before submitting the application form, here is a checklist of application fee and required documents for APL and BPL categories. According to this, whichever category you belong to, you will have to pay the fee for that category along with your application form.

| Category | Renewal Fee | Required Documents |

|---|---|---|

| BPL (Below Poverty Line) | ₹250 | • Disability certificate (Self-attested), issued by the District Hospital or an appropriate Government authority. • BPL card. • Address Proof. • Proof of payment. |

| Above Poverty Line (APL) If family Income up to ₹15000 per month | ₹250 | • Disability certificate (Self-attested), issued by the District Hospital or an appropriate Government authority. • Address Proof. • Proof of payment. • Income certificate (Self-attested) from the parent/guardian, issued by the competent authority as issued by the State. |

| Above Poverty Line (APL) – If family Income above ₹15000 per month | ₹500 | • Disability certificate (Self-attested), issued by the competent authority of the State. • Address Proof. • Proof of payment. |

6. Submit the Application: After verification of the documents, RO will upload the application form documents on the official website of National Trust for further processing.

7. Pay the Application Fee: You have to pay the application fee online. This fee depends on whether the applicant is from BPL or APL category.

8. Application Review by National Trust: Once your application is submitted, the National Trust will review the form and all the documents and if everything is in correct, they will approve the application.

How to Renew Your Niramaya Health Insurance

The renewal process for the Niramaya Health Insurance Scheme is straightforward and needs to be done every year to keep receiving the benefits. Below is a clear breakdown of the renewal fees and required documents based on the PwD category.

- Visit the Nearest Registered Organization (RO):

To renew your Niramaya Health Insurance, go to the nearest Registered Organization (RO). The parent or guardian of the person with a disability should initiate the renewal process at the RO. You can locate your nearest RO by visiting the National Trust website. - Bring Required Documents

You need to carry your current Health card, along with other supporting documents such as the disability certificate, address proof, and any other required documents for renewal. The exact list of documents might vary, so it’s a good idea to check the official website or ask your RO. - Verification of Documents

The RO staff will verify the documents you’ve brought for renewal. Ensure all documents are up-to-date to avoid delays in the renewal process. - Complete the Renewal Form

The RO staff will assist you in filling out the online renewal form. You’ll need to provide updated details and confirm the accuracy of your personal and medical information. - Submit the Renewal Application

Once the renewal form is complete, the RO will submit it online through the National Trust’s portal for processing. Make sure that the form is submitted before the current coverage expires. - Pay the Renewal Fee

A renewal fee is required to continue coverage for another year. Below is a Renewal Fee and Required Documents Checklist for different categories (APL and BPL):

| Category | Renewal Fee | Required Documents |

|---|---|---|

| BPL (Below Poverty Line) | ₹0 | • BPL card. •Address Proof (only if there has been a change of address). |

| Above Poverty Line (APL) If family Income up to ₹15000 per month | ₹250 | • Address Proof (only if there has been a change of address). • Income certificate (Self-attested) of the parent/guardian, issued by the competent authority as issued by the State. • Proof of payment. |

| Above Poverty Line (APL) If family Income above ₹15000 per month | ₹500 | • Proof of payment. • Address proof (only if there has been a change of address). |

How to Find the Nearest Registered Organization (RO)

To apply for the Niramaya Health Insurance Scheme, you need to visit nearest Registered Organization (RO). Here’s how you can find the nearest one:

- Visit the Official National Trust Website: The National Trust website has a dedicated page where you can find a list of all registered organizations. To find the nearest RO to you, visit this official page.

- Search by Location: You can search for Registered Organizations by state, which will give you a list of authorized centers in your area.

- Contact Details: Each RO listed on the website will have contact information, including the address, phone number, and email, so you can reach out for assistance.

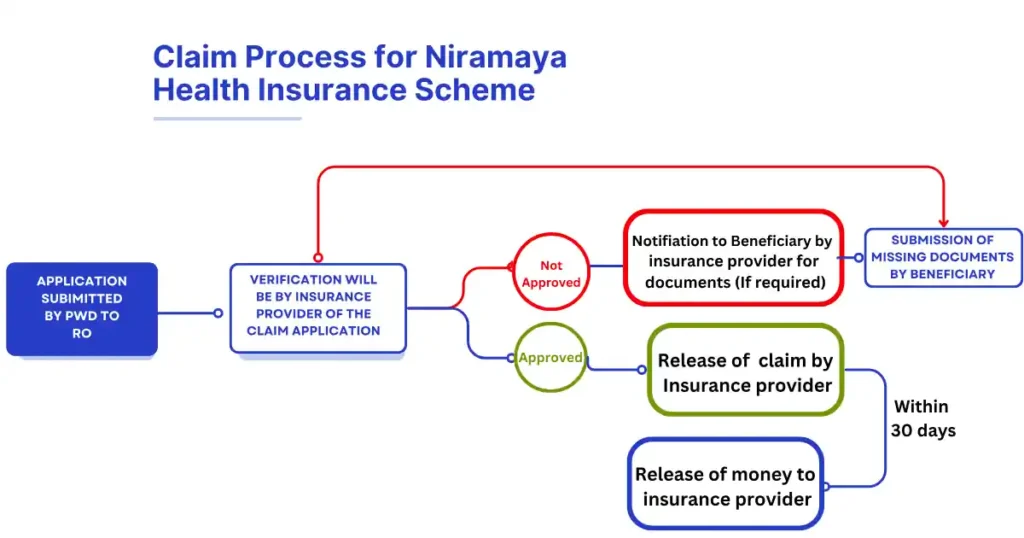

How to Make Claims for Niramaya Health Insurance?

- Download the Claim Form

- Visit the official website Niramaya health insurance Claim form to download the claim form.

- Fill Out the Claim Form

- Complete the claim form.

- Attach the required supporting documents, such as:

- Medical bills

- Prescription

- Hospitalization report

- Discharge card

- Any other relevant documents

- Submit the filled claim form and documents to the regional centers of the insurance provider.

- Insurance Provider Verification

- The insurance provider will check all submitted documents.

- Once approved, the claim amount will be transferred directly to the beneficiary’s bank account as per the IRDA (Insurance Regulatory and Development Authority) guidelines.

Documents Required for the Claim Process: • Copy of Niramaya Health ID card (or mention your Health ID No.) • Self-attested copy of your Disability Certificate • Original prescriptions from the doctor •Original hospital bills (including doctor’s fees, therapy, transportation costs, etc.) • Medical reports (in original) • Bank details: Account Number, Bank Name, Branch (City & State), IFSC Code, Name of Account Holder.

Key Points to Remember:

- Submit the claim within 30 days of treatment or discharge from the hospital.

- Ensure all documents are original and accurate.

- For any updates or changes, check the official website regularly.

Niramaya vs. Other Health Schemes

| Feature | Niramaya | Ayushman Bharat | State Schemes |

|---|---|---|---|

| Eligibility | PwDs | General population | Varies by state |

| Annual Premium | ₹250-₹500 | Free | Varies |

| Coverage Limit | ₹1,00,000 | ₹5,00,000 | Varies |

| Pre-Existing Conditions | Covered from Day 1 | Covered | Varies |

Official Sources:

- National Trust Website: www.thenationaltrust.gov.in

- Official Claim Status Check: Raksha TPA

- Helpline: Contact persons of Raksha TPA (Oriental Insurance Co.)

| NAME | CONTACT NO | EMAIL ID |

|---|---|---|

| Claim Related Information | 04068178547 | crcm@rakshatpa.com |

| Mr. Ashok Narwat | M: 7838151524 | ashok.narwat@rakshatpa.com |

| Ms. sushma Rawat | 7838151573 | sushma.rawat@rakshatpa.com |

| Oriental Insurance Co | mukesh.goel@orientalinsurance.co.in |

Final Thoughts on the Niramaya Health Insurance Scheme

As someone who understands the importance of accessible healthcare, I believe the Niramaya Health Insurance Scheme is a lifeline for individuals with disabilities and their families. It provides not just financial relief but also the reassurance that medical needs can be met without overwhelming expenses.

The application and renewal process of this scheme is simple and with the right guidance any eligible person can avail the benefits easily. I encourage you to take advantage of this opportunity to gather the necessary documentation and secure the health care coverage for you or your loved one.

We want you to consider such schemes first and if you like the scheme, then you should give information about it to your known or acquaintance who needs the scheme. So that he can also take advantage of this Niramaya Health Insurance Scheme and make his life a little easier.

Frequently Asked Questions (FAQs)

Can multiple beneficiaries from the same family enroll?

Yes, each eligible member can enroll separately, but fees must be paid for each beneficiary.

What happens if I miss the renewal deadline?

The policy will lapse, and you will need to re-enroll as a new beneficiary, which may result in coverage gaps.

Is the scheme applicable across India?

No, Niramaya health insurance scheme is valid across all states and UTs in India except Jammu & Kashmir.

Can the Niramaya scheme cover treatment abroad?

No, the Niramaya scheme only covers medical treatments within India.

How long does it take to process a claim?

Claim processing usually takes 7-15 business days after submission of all documents.

Can I change my Registered Organization (RO)?

Yes, you can request a change of RO by contacting the National Trust helpline.

Can I avail of the scheme for preventive health checkups?

No, the scheme does not cover preventive health checkups or wellness programs.

What should I do if I lose my insurance card?

Report the loss to your RO and request a replacement card.