Gratuity Calculator: Calculate Your Gratuity in Seconds

This tool calculates gratuity based on your basic salary and years of service. Enter your details and click “Calculate” to view the gratuity amount.

Indian Gratuity Calculator

Enter your last drawn monthly basic salary plus dearness allowance

Your Gratuity Amount:

How to Calculate Gratuity: Step-by-Step Guide Calculation Formula

Gratuity is a financial benefit provided to employees as a token of appreciation for their service. Here’s everything you need to know, including the gratuity formula, eligibility criteria, and an example calculation.

Gratuity Formula

The formula to calculate gratuity for employees covered under the Payment of Gratuity Act, 1972 in India is as follows:

Gratuity = (Basic Salary + Dearness Allowance) × 15 × Years of Service / 26

This gratuity calculation formula is widely used and ensures consistency in calculating gratuity amounts.

Eligibility Criteria for Gratuity:

- Basic Salary and DA: Gratuity is calculated based on basic pay and dearness allowance (if applicable).

- Years of Service: The number of years of service is rounded down to the nearest full year. For instance, 7 years and 6 months is considered 7 years.

- 15 Days Rule: Gratuity is calculated as 15 days of pay for each completed year of service, as per the Payment of Gratuity Act, 1972.

- 26 Days in a Month: For gratuity purposes, a month is considered to have 26 working days.

If you want to withdraw gratuity by manually, so you need to fill manual FORM 'l' APPLICATION

Gratuity Calculation Example

Let’s consider an example:

- Basic salary: ₹30,000 per month

- Years of service: 8 years

- Gratuity Formula Applied: Gratuity = (₹30,000 × 15 × 8) / 26 = ₹138,461

- The employee is covered under the Payment of Gratuity Act.

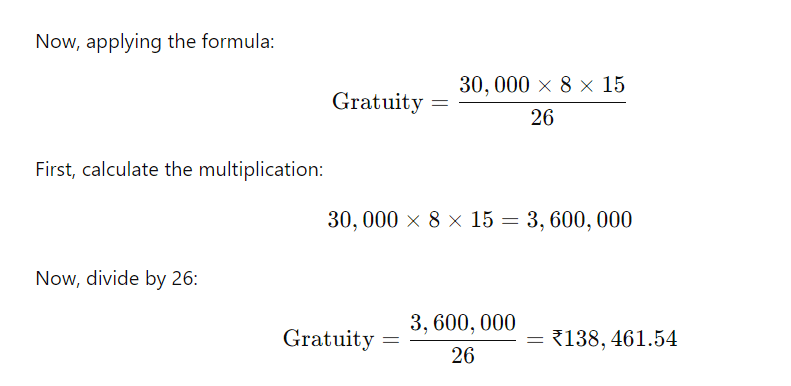

Now, applying the formula:

Using the gratuity calculator formula, the employee would be eligible for a gratuity of ₹138,461.

For official information on the Payment of Gratuity Act, 1972, visit the Ministry of Labor and Employment’s website Payment of Gratuity Act, 1972

Important Notes on Gratuity Eligibility

- Eligibility: Gratuity is only payable after completing 5 years of continuous service with the employer.

- Different Calculations for Non-Covered Employees: Employees not covered under the Payment of Gratuity Act, 1972 might have gratuity calculated differently, but many organizations follow the above formula for simplicity.

Official Sources:

- For official details on the Payment of Gratuity Act, 1972

- Visit the Ministry of Labor and Employment‘s website

FAQs About Gratuity

1. Is gratuity taxable?

Gratuity is tax-free up to ₹20 lakh for employees covered under the Payment of Gratuity Act, 1972. Any amount beyond this limit is taxable as per the individual’s income tax slab.

2. Can gratuity be paid before completing 5 years of service?

Gratuity is typically payable only after completing 5 years of continuous service. However, in case of death or disability, this requirement is waived.

3. What happens to gratuity if I switch jobs?

If you switch jobs, your gratuity from the previous employer is settled, and the new employer calculates gratuity from the start of your employment with them.

4. Is gratuity mandatory for all employers?

Gratuity is mandatory for organizations with 10 or more employees. Smaller organizations may offer gratuity voluntarily.

5. How is gratuity calculated for employees not covered under the Act?

For employees not covered under the Act, gratuity is calculated as:

Gratuity = (Basic Salary + DA) × Years of Service × ½

6. Can an employer deny gratuity payment?

An employer can deny gratuity payment only in cases of employee misconduct, such as fraud, theft, or causing willful damage to property.

7. Is gratuity included in CTC (Cost to Company)?

Yes, gratuity is often included in the CTC, but it is paid only after you meet the eligibility criteria.

8. Can gratuity be transferred to a new employer?

Gratuity cannot be transferred between employers. It must be claimed separately from each employer upon leaving.

9. Does gratuity amount increase with a salary hike?

Yes, the gratuity amount increases with a salary hike since it is calculated based on the latest basic salary and DA.

10. How long does it take to receive gratuity after leaving a job?

Employers are required to pay gratuity within 30 days of an employee leaving the organization.

Explore our full range of calculators to simplify your tasks. 👉 Discover More Calculators